Computer fixed asset depreciation

When assets are acquired they should be recorded as fixed assets if they meet the following two criteria. A 5000 computer will become a fixed asset.

How To Prepare Depreciation Schedule In Excel Youtube

Go to the Accounting menu.

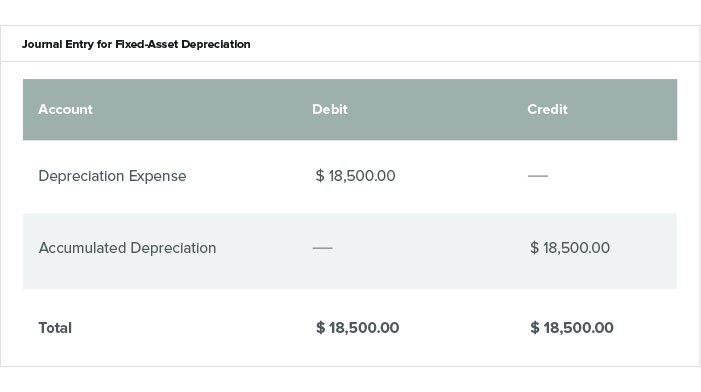

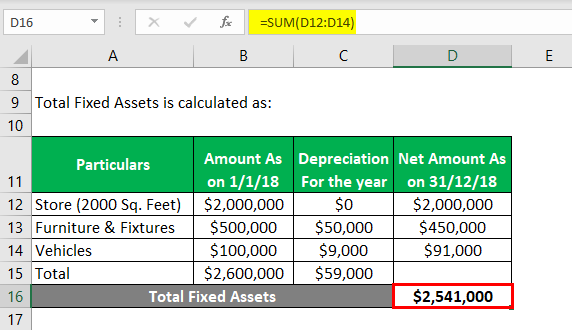

. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet and is charged as an expenditure to a profit and loss account. Select Chart of Accounts. Depreciation of fixed assets consists of spreading the purchase value of an.

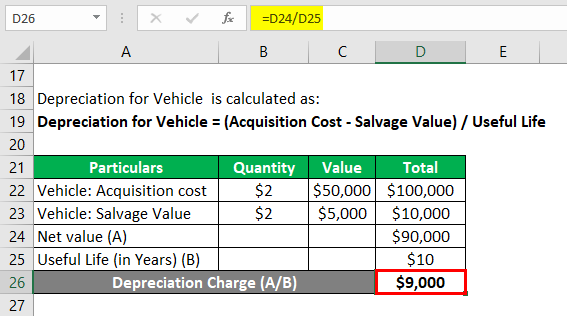

The depreciation expense is the amount by which you reduce your fixed asset value on an annual basis. Type useful life into cell A3. From the Account Type dropdown select Tangible Assets.

The depreciation allows to notice the depreciation of an asset due to wear time or obsolescence. From the Detail Type dropdown choose. The asset must be acquired purchased gift-in-kind for use in operations.

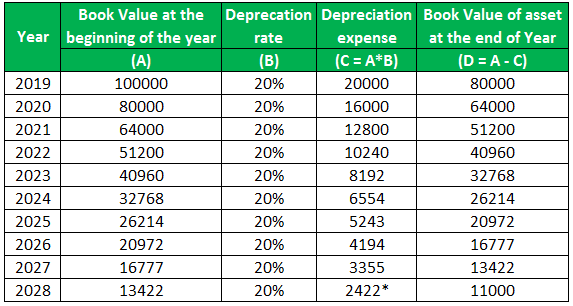

Rate of Depreciation for Computer Laptops under Straight line method is 3167 per year and Written down value method is 6316 per year. The cost will be expensed on the income statement. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the.

Next type salvage value into cell A2 and 500 into cell B2. A 2500 computer will not become a fixed asset. To be considered for capitalization and thus subject to depreciation an asset must fulfill three characteristics.

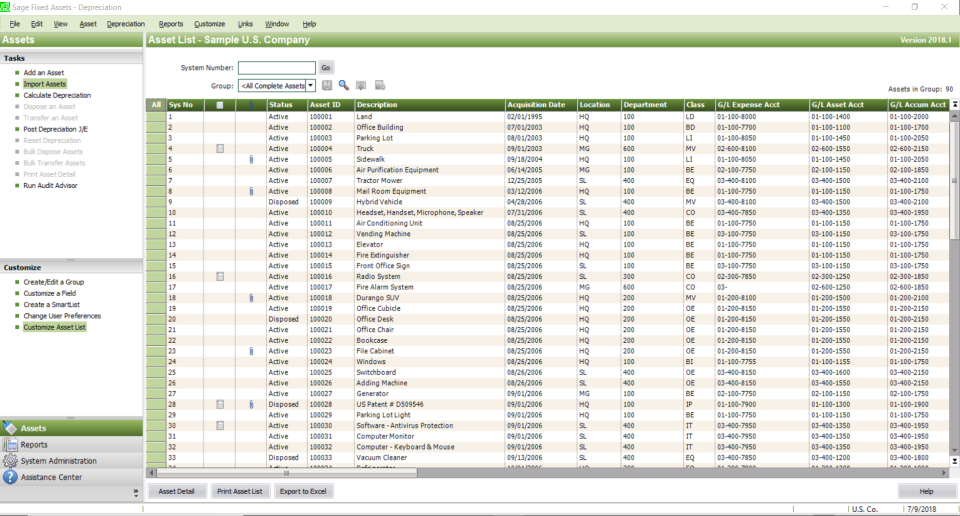

Fixed assets also known as tangible assets or property plant and equipment PPEis an accounting term for assets and property that cannot be easily converted into. Understanding Fixed Asset Depreciation Type cost into cell A1 and 5000 into B1. Rate of Depreciation for Servers and networks.

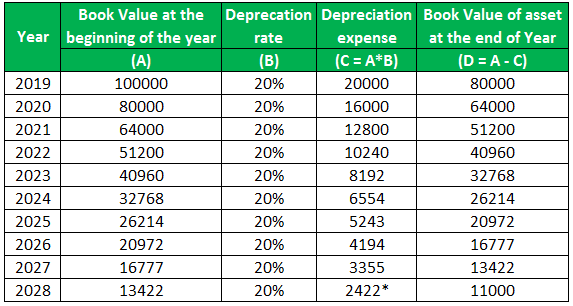

The cost will become an. When to Classify an Asset as a Fixed Asset. Straight-line depreciation This is the most basic version of depreciation in which you pay equal annual installments until the entire asset is depreciated to its salvage value.

In our example above suppose that the value of the computer. Have a useful life of. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet and is charged as an expenditure to a profit and loss account.

Fixed Asset Journal Entries Depreciation Entry Accumulated Depreciation Youtube

Fixed Asset Accounting Made Simple Netsuite

Top 10 Fixed Asset Management Software Free Paid Softwareworld

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Fixed Asset Inventory Report Depreciation Guru

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

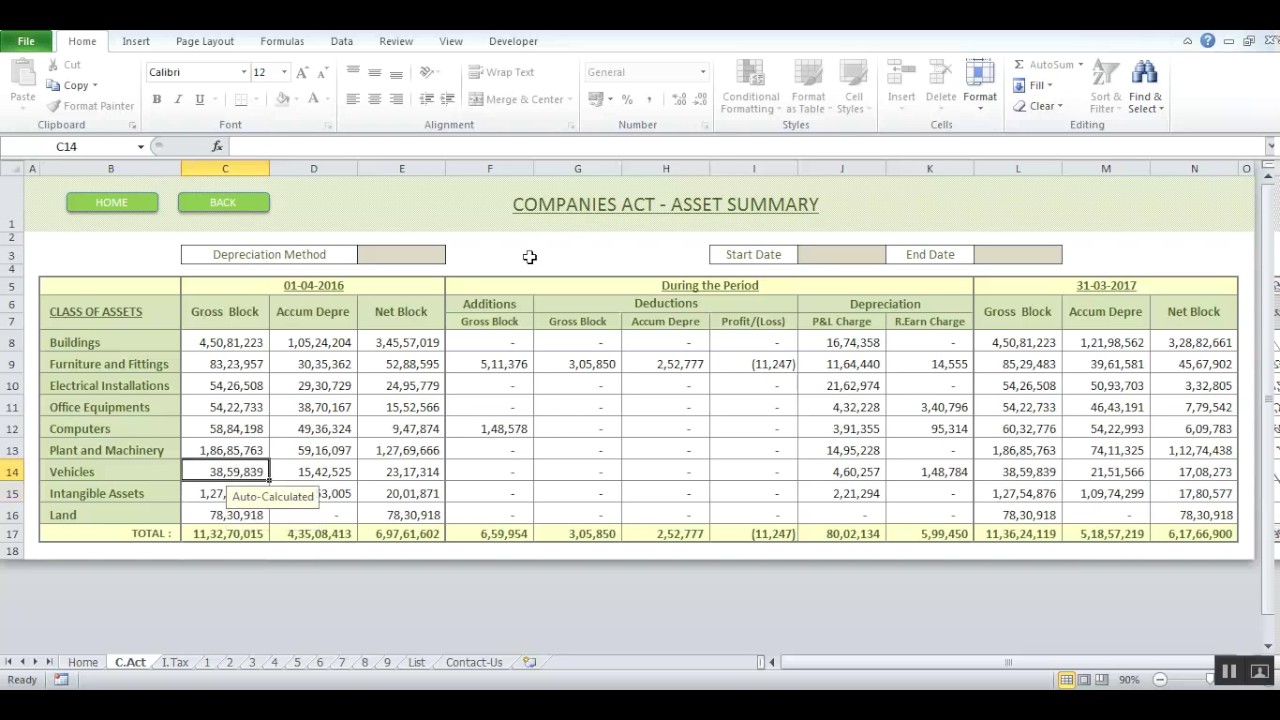

Depreciation Calculator For Companies Act 2013 Fixed Asset Register Youtube

What Is Fixed Asset Type Tangible Intangible Accounting Dep

The Basics Of Computer Software Depreciation Common Questions Answered

Fixed Asset Register Depreciating Your Assets What You Need To Know

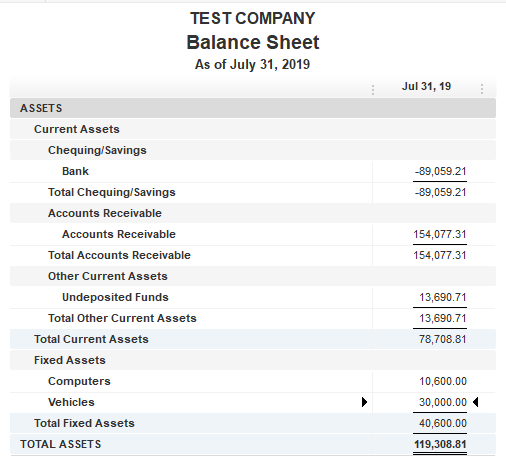

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Fixed Asset Register Depreciating Your Assets What You Need To Know

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Computer Software Depreciation Calculation Depreciation Guru

Depreciation Rate Formula Examples How To Calculate